According to the government department, Immigration, Refugees, and Citizenship Canada, permanent resident status was granted to 471,550 individuals in 2023. This was 31,970 more than were given permanent resident status in 2022 and it was the largest number on record. It also exceeded the Ottawa’s target of 465,000 announced by Immigration Minister Sean Fraser in November 2022.

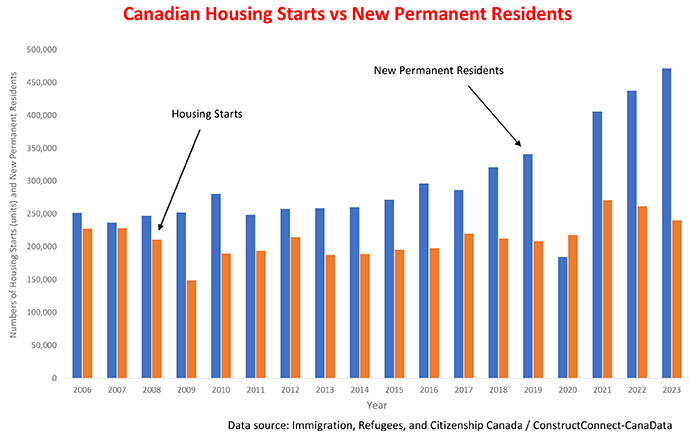

As the chart illustrates, the volume of permanent residents admitted to Canada has increased by almost 90% since 2006 and is projected, based on the Liberal Government’s immigration target, to reach 485,000 in 2024 and 500,000 in 2025.

Record number of permanent residents drives rental vacancy rate to new low

The chart also illustrates the extent to which the inflow of permanent residents has outpaced housing starts over the past eight years. Whereas in 2012 there were approximately 1.2 new permanent residents per housing start, by 2023 the ratio had almost doubled.

Since recently arrived permanent residents usually have limited resources, most rent rather than own. According to Statistics Canada, 56.9% of the 1,328,000 immigrants who entered the country between 2016 and 2021 lived in rented accommodation. Given the impact of this sustained surge in demand for rental accommodation, the apartment vacancy rate for the country has, over the past eight years, dropped from 3.7% to a record low of 1.5%.

While the federal government has promised to “stabilize” the immigration target, it has announced no plans to scale back what is still a very aggressive immigration target. Going forward, it is unlikely that the shortage of residential dwellings is going to be resolved in the short-term given that housing starts in the country contracted by -3.4% in 2022 and by even more, -8.2%, in 2023.

At the same time, the volume of residential building permits has dropped by -26% over the past two years in large part due to a -37% decline in the volume of applications to build single-family dwelling units, plus a -17% drop in multiples.

Ratio of permanent residents to housing starts is highest in Saskatchewan

Across the country, the ratio of new permanent residents to housing starts provides a clear measure of the relationship between the supply of ownership and rental accommodation vis-a-vis the demand for it boosted by the record population inflows.

Provincially, Saskatchewan is at the top of the list. In that province, the volume of permanent residents increased by 21,675 (+30.2%) in 2022 followed by a gain of 25,155 (+14.9%) in 2023.

Fueled by this surge in demand, residential construction posted a gain of +1% in 2022 and by +10% in 2023. However, these increases were outweighed by the inflow of permanent residents causing the ratio of ‘new residents’-to-‘housing starts’ to jump from 2.6 in 2021 to 5.1 in 2022 and a record 5.4 in 2023. At the same time, the apartment vacancy rate in the province dropped from 6.1% in 2021 to 4.1% in 2022 and to a ten-year low of 2.4% in 2023.

After Saskatchewan, Newfoundland and Labrador ranks number two in terms of the ratio of new permanent residents to housing starts. After jumping by +70% in 2022, the volume of individuals taking up residence on the Rock rose by +57% in 2023. The effect of the surge in permanent residents was exacerbated by a -30% drop in housing starts.

Shortage of accommodation less acute in Quebec, B.C., Alberta, and N.S.

While no province can claim to have an excess of vacant ownership or rental accommodation, to state it mildly, the ratios of new permanent residents to housing starts in Quebec (1.4), British Columbia (1.4), Alberta (1.6), and Nova Scotia (1.6) are all under the national average of 1.8. This suggests the shortage of both ownership and rental accommodation in those provinces is not as acute as it is in the other six provinces.

The back-to-back pickup in home sales in December and January, the decline in fixed mortgage rates since October, and the levelling out of the Bank of Canada’s policy rate all suggest the outlook for housing has recently brightened. However, there continue to be too many factors threatening to slow the extent to which the gap between the supply of and demand for new residences narrows.

Recent Comments

comments for this post are closed