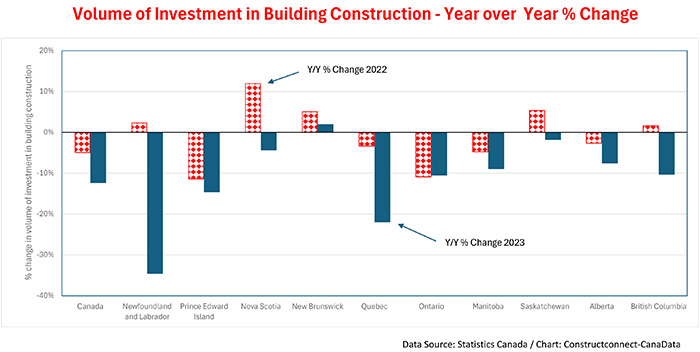

A higher policy-setting interest rate, which the Bank of Canada has raised to a 22-year peak in order to rein in inflation, caused the volume of investment in building construction to contract by -4.8% in 2022 and by a further -13.0% year-to-date in 2023.

By sub-categories, the combination of a -23% drop in single-family buildings and a -12% retreat in multiple-unit structures caused investment in total residential buildings to decline by -19% in the first ten months of 2023. The decline in residential investment more than offset a small +0.8% increase in non-residential investment.

Year-to-date construction contraction in nine out of ten provinces

Across the country, total investment in building construction declined in nine of the ten provinces, led by Newfoundland and Labrador (-35.0%), Quebec (-22.9%), Prince Edward Island (-18.5%), and Ontario (-10.3%). The only province in which investment in building construction increased in 2023 was New Brunswick (+10.5%). In N.B., an increase in construction of multiple-unit dwellings, a +6% rise in industrial construction, and a +32% jump in spending on institutional projects caused the total value of investment in buildings to increase by +1.9%.

The possibility of labour hoarding

The fact total Canadian construction employment increased by +6.7% in 2022 and by +3.5% in 2023 despite the above-mentioned back-to-back declines in investment in building construction reinforces the view, held by many, and highlighted in Snapshot #22 2022, that firms, expecting a mild slowdown, were hanging on to key workers in order to avoid being short-staffed when conditions improved. The job vacancy rate in construction is still above the ‘all jobs’ national average.

Barrie, Lethbridge, Belleville leaders in construction hiring

Although the demand for construction labour remains robust, as reflected by the high construction job vacancy rate, the pattern of job growth in the country’s 33 census metro areas varies considerably.

Starting with the ‘hottest’ job market, the number of construction jobs in Barrie in 2023 increased by +31% due largely to a +133% jump in investment in industrial projects, which more than offset a -21% decline in investment in residential building.

After Barrie, the number of construction jobs in Lethbridge, Alberta posted the second largest percentage gain of +26%, primarily driven by a +79% rise in investment in commercial projects, plus the lingering impact of a +101% climb in spending on multiple-unit dwellings in 2022.

Other CMAs which saw above-average increases in construction hiring last year included Bellville, Ontario (+25%), Kelowna, B.C. (+23%), and Ottawa-Gatineau, Ontario/Quebec (19%).

Despite, modest gains of investment in industrial projects, institutional, and single-family dwelling projects, construction employment shrank in Saguenay, Quebec (-26%), Abbotsford-Mission, British Columbia, (-20%), and Peterborough, Ontario (-15%).

Cooling inflation and lower interest rates will lead to better second half

Turning to the investment outlook and, by implication, the prospects for construction employment, the recent weakness in applications to build single- and multi-unit residential dwellings will dampen their near-term performance. However, the slight easing in labour shortages noted in the , suggests inflationary expectations are starting to cool, potentially enabling the Bank to ease monetary policy, thereby brightening Canada’s economic horizon in the second half of this year.

We expect that the release of Statistics Canada’s nonresidential capital and repair expenditure survey in late February will provide a clearer picture of the outlook for construction spending and hiring in the industry this year.

Recent Comments

comments for this post are closed