��

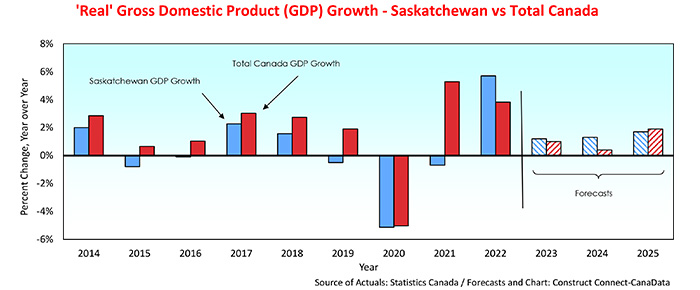

In 2023, weak resource exports hobble the wheat province

After posting a country-leading ‘real’ (i.e., after inflation) GDP gain of +6.0% in 2022, the Saskatchewan economy is projected to slow sharply to an estimated +1.2% in 2023. This retreat has been primarily due to three factors. First, exports of potash, which account for 11 percent of the province’s GDP, have fallen by -39% after Russia and Belarus resumed shipments that had been embargoed in February of 2022 following Russia’s invasion of Ukraine.

In the wake of the extended downtrend in potash prices, Nutrien, the largest fertilizer company in Canada, announced that it is reducing its estimate of full-year earnings, which will likely temper its capital spending plans for 2024.

Second, due to the steady decline in oil prices between mid-2022 and mid-2023, the value of Saskatchewan’s energy exports has fallen by just under -60%.��

Third, drought conditions have continued to depress crop production. As a result, only two major crops, winter wheat and hard red spring wheat, have managed yields exceeding their ten-year averages.

The one commodity that has given a significant boost to Saskatchewan’s foreign sales is uranium. Over the past ten months, spot uranium prices have increased +44% while exports of the commodity are up by +80%. Given that world uranium mines are currently able to supply only about 75% of global demand, exports are projected to steadily increase over the next several years.

��

Dampening influences on consumer spending

Consistent with the slowdown in overall growth and despite an unprecedented inflow of 23,000 permanent and 8,010 non-permanent residents, total employment in the province has increased by a modest +1.4% year to date, following a gain of +4.5% in 2022.��

Given the impact of higher interest rates on interest-sensitive elements of spending, the eroding impact of high inflation on disposable incomes, and a steady slide in the percentage of consumers who think now is a good time to make a major purchase, it is not surprising that inflation-adjusted consumer spending in Saskatchewan has contracted by -3.4% year to date after rising by +1.4% during the first nine months of 2022.

Going forward, the lingering effects of sluggish disposable income growth and the erosion of consumer confidence cast a shadow over the outlook for consumer spending well into 2024.

��

Record international migration drives rental accommodation demand

The same factors contributing to the erosion of inflation-adjusted consumer spending are largely responsible for causing sales of existing homes to drop by -9 % in 2022 and by a further -6% so far this year. In line with the back-to-back declines in existing home sales, the bulk of which are single-family, the surge in net migration appears to have given a boost to the construction of multiple units.��

While applications to build single-family dwelling units dropped by -32% in the first nine months of this year, multiple-unit building permits have been up +50%. The latest data on housing starts parallels the data on building permits, with single-family starts down by -32% year to date and apartment starts up by +49% over the same period.

As with building permits and housing starts, the year-to-date increase in prices of single-family dwellings, +1.7%, is much smaller than the average increase in prices of townhouses, +6.6%, and apartments, +3.3%. Assuming inflation moderates mid-way through 2024, enabling the Bank of Canada to relax monetary policy, the combination of lower interest rates and higher real incomes should contribute to a pick-up in housing demand in the second half of next year.

Capital spending to cool in 2024 and 2025

Although somewhat dated, the most recent Non-residential capital and repair expenditure survey undertaken in late 2022 reported that businesses and government planned to increase their investment in non-residential construction and machinery and equipment in 2023 by +21.5%, following a +19.7% gain in 2022.

That said, the recent announcement by Nutrien of its intention to indefinitely pause its plan to ramp-up potash production casts a shadow over Saskatchewan’s 2024 capital spending plans. However, the impact of this pause should be offset in part by BHP, the world’s largest miner, which recently announced that, despite the drop in potash prices, it is increasing the capital spending on its Jansen project by +55%.����

Easier money to boost growth in H2 2024 and in 2025

Since the Saskatchewan economy is heavily dependent on resources,�� ̶�� i.e. potash, agricultural products, and uranium,�� ̶�� its near-term prospects are heavily influenced by variables such as the weather which are almost impossible to predict.

Assuming inflation continues to moderate, enabling the Bank of Canada to ease monetary policy, we expect interest-sensitive housing, business investment, and consumer spending to regain some of their lost momentum in the second half of 2024 and through 2025.�� However, the depressed first half will start the year off on a weak note. Based on this growth profile, we expect the Saskatchewan economy to grow by +1.3% in 2024 and by +1.7% in 2025.

Recent Comments

comments for this post are closed