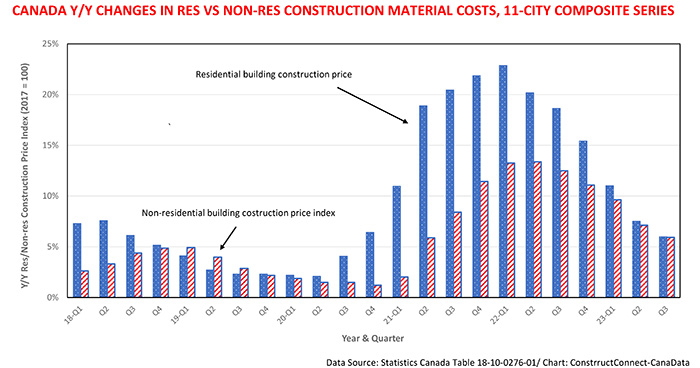

After posting a year-over-year increase of +22.9% in Q1 2022, a 40-year high, residential building construction costs in Canada’s 11 largest metros have trended steadily lower to their current (Q3/2023) pace of +6% y/y. Since non-residential construction was not fuelled by extremely low interest rates and record net immigration to the same extent, it did not head into the stratosphere to the same degree as residential building construction costs. As a result, non-res costs peaked at +13.4% in Q2/2022, a quarter after residential building construction costs. However, the gradual increase in interest rates since the first quarter of 2022 has, by eroding affordability, severely depressed existing home sales and caused residential construction costs to exhibit their slowest growth since Q2 2020.

Climb in residential building construction price index hits 3-year low

Among the 11 major metro areas surveyed by Statistics Canada, the Q3 2023 change in residential building construction costs ranged from -0.4% y/y in Edmonton to +10.0% y/y in Toronto. Factors contributing to the above-average increase in residential building construction costs in Toronto have included shortages of skilled labor, plus outsized increases in costs for masonry (+19.4%), equipment (+18.8%), finishes (+17.6%), concrete (+16.1%), thermal and moisture protection (+15.0%). In second place, construction costs for residential buildings increased by +8.4% y/y in Halifax, Nova Scotia.

Moderation in non-residential construction costs

Depressed in part by the federal government’s efforts to discourage investment in fossil fuel projects, by the post-covid increase in office vacancy rates, and by the fact that non-residential construction as a percentage of GDP has been dropping, it is not that surprising that with few city exceptions non-residential building costs did not spike as high as residential building construction costs in early 2022.

Year to date, the biggest increase in non-res building costs has occurred in Moncton, New Brunswick due in part to hikes in the cost of earthwork (+29.1%), masonry (+23.3%), concrete (+21.7%), thermal and moisture protection (+17.1%), and structural steel framing (+13.1%). After Moncton, y/y non-res building costs have increased by +8.1% in Vancouver, +7.2% in Ottawa, and +6.6% in Toronto.

��

Lingering tight monetary policy likely to cool construction costs further

Key forward-looking indicators of both residential and non-residential building construction price indexes are continuing to trend lower into the second half of 2024. First, as the Bank of Canada noted in its , although “the slowdown in the economy is reducing inflationary pressure… the Governing Council wants to see further and sustained easing in core inflation”.�� This suggests the Bank will remain on the sidelines, causing interest rates to continue to depress sales of existing residential dwellings and restrict new construction into H2 of next year.

Also, the combination of declining net worth caused by weaker financial and housing markets, plus an increase in the debt service ratio (i.e., the total obligations of principal and interest on credit market debt as a proportion of household disposable incomes) will intensify the downward pressure on housing demand and ultimately on residential building construction price indexes.��

Weak single-family outlook to disproportionately affect construction costs

Year to date, the approvals of residential dwellings are down by -7% for the country as a whole, primarily as a result of a -30% ytd drop in plans to build single-family units that more than offsets a +1% rise in approvals of multiple units. Across the country, above-average declines in building permits have occurred in St. John’s, Newfoundland (-27%), Montreal (-24%), Moncton (-23%), and Edmonton (-21%). We expect that the outsized declines in new residential construction in those census metro areas will depress their construction costs relative to the rest of the country.��

High office vacancy rates to weigh on non-res construction costs

Given the steady decline in year-over-year growth of gross fixed capital spending over the past year and a half and the Bank of Canada’s observation in the Q3/23 that the net percentage of surveyed firms expecting to increase their investment in plant and equipment dropped to a three-year low suggests non-res construction will remain depressed throughout much of 2024. This outlook is reinforced by the high level of post-covid office vacancy rates in most major census metro areas, which will cause non-residential construction costs to continue to trend lower in 2025.

Recent Comments

comments for this post are closed