The most recent (August) released by Statistics Canada reinforce the view, held by many, that the federal government’s efforts to close the “housing gap” ( i.e., the additional number of housing units necessary to reach an adequate level of affordability) are very unlikely to be successful. After posting a slight (+1.5% m/m) gain in July, the number of building permits issued in August contracted by -3.7%, due to a -15% m/m drop in applications to build multiple units that more than offset a +5.1% increase in single-family units.

Since 2021, the total number of building approvals has contracted by -14% due to a drop in approvals for singles (-38% year to date) and multiples (-5% ytd). There is little doubt that the declines in residential building approvals are the result of a sharp (-15% ytd) plummet in home sales, primarily resulting from the steady rise in interest rates since Q1 of last year to a 22-year high.

Two factors will keep new construction depressed

While the building permit data only reflects residential building intentions through August, two factors indicate that new construction will remain depressed well into 2024. First, home sales have declined for three consecutive months and the Canadian Real Estate Association (CREA) has scaled back its projected year-over-year change in existing home sales in 2023 from -6.8% to -9.0% and in 2024, from +11.1% to +9.0%. Second, there is a growing consensus that persisting above-target inflation will cause the Bank of Canada to “sit tight” and leave interest rates “as is” well into the first half of next year.

Trends in interest rates, demand, and supply point to higher prices

Looking forward, assuming inflation moves into the Bank of Canada’s target range of +1% to +3% by mid-2024, we expect interest rates to then move lower. However, lower interest rates, plus a record increase in permanent and temporary immigration during the preceding 12 months will bring more first-time buyers into the marketplace. As a result, house prices, which have recently retreated in several major markets, will likely begin to ramp higher again, leading to worsening affordability.

The housing gap is not going away soon

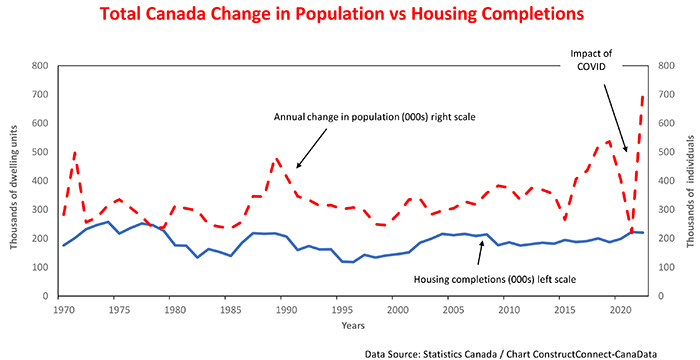

A recent study authored by Josef Filipowicz of the Fraser Institute titled highlights the extent to which the difference between housing demand, reflected by population growth, and housing supply, indicated by new home completions, has increased over the past 50 years. As a result, Canada has experienced a major deterioration in housing affordability.

Moreover, it appears highly unlikely that this unprecedented imbalance between housing supply and demand will disappear in the short term. In a recent report titled Housing Shortages in Canada, Canada Mortgage and Housing Corporation (CMHC) estimates that providing an adequate supply of affordable dwellings by 2030 will require the construction of 5.2 million dwelling units. This implies Canada will need to build approximately 750,000 units a year. To put this number in perspective, over the past 20 years, annual housing completions in Canada have averaged 190,000 units.

The Filipowicz report indicates that over the past 50 years, the growth of Canada’s population has steadily outpaced the rate of increase of the country’s housing stock. The extent of the undersupply of new dwellings vs population growth is highlighted by the fact that over the period 2012 to 2021, Canada’s population grew on average by +400,000 a year while housing completions over the same period averaged 189,000.

With the lingering impact of high-interest rates and the prospect of sustained, relatively strong net international migration, there appears to be little chance that the gap between the supply and the demand for housing will shrink significantly in the foreseeable future.

Moreover, in Ontario, a province with the most acute shortage of affordable accommodation, this prospect is reinforced by the recent decision by the provincial government to backtrack on its approval to permit the construction of 50,000 homes on land in the “Greenbelt” while at the same time increasing the total area of the protected lands by 2000 acres.

Recent Comments

comments for this post are closed