North America’s major stock markets sailed through the latest October in fine fettle. October historically has been the month when some of the biggest stock market disasters have occurred. There was the infamous Crash of 1929 and Black Monday of 1987.

But this time around, it was smooth sailing. And that was despite statements by the Federal Reserve that further interest rate hikes are in the offing. In fact, today, November 2, a further 75 basis point bump in the federal funds rate is almost guaranteed (where 100 basis points = 1.00%).

But this time around, it was smooth sailing. And that was despite statements by the Federal Reserve that further interest rate hikes are in the offing. In fact, today, November 2, a further 75 basis point bump in the federal funds rate is almost guaranteed (where 100 basis points = 1.00%).

The Federal Open Market Committee (FOMC) is meeting as this article is being written and it has another session scheduled this year for December 13-14. The top of the range for the federal funds rate will soon be 4.00%. The key question concerns how much further it will be lifted.

We’ll soon know to what degree investors have already factored in more interest rate increases.

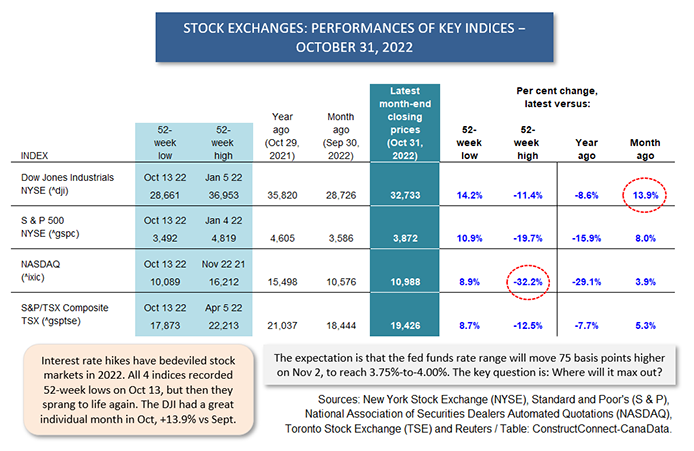

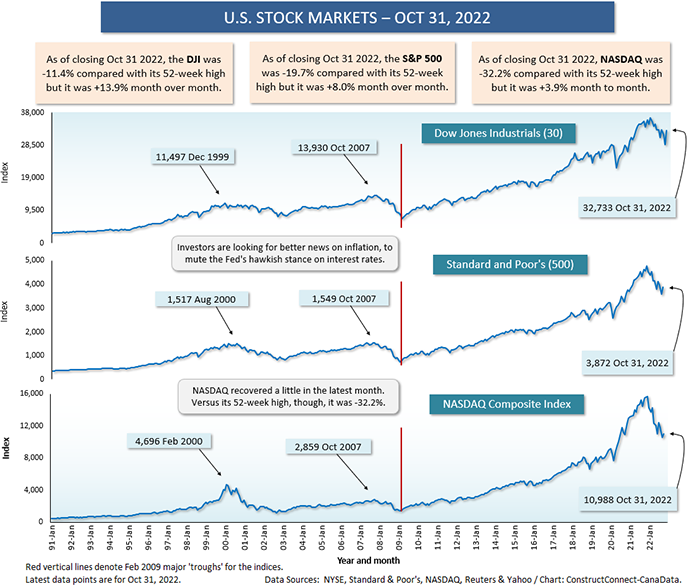

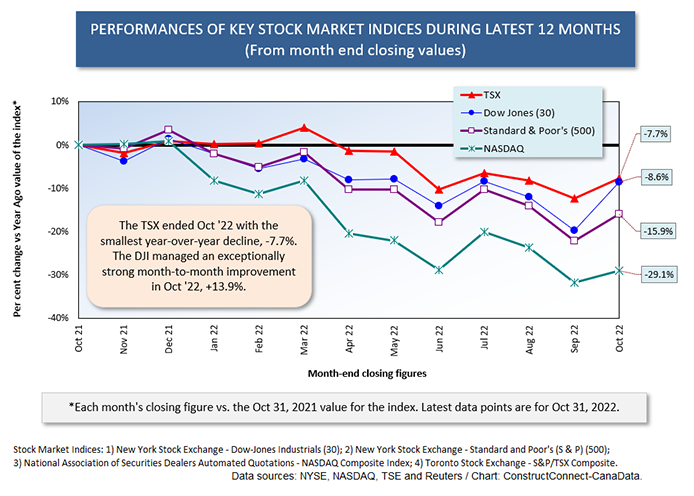

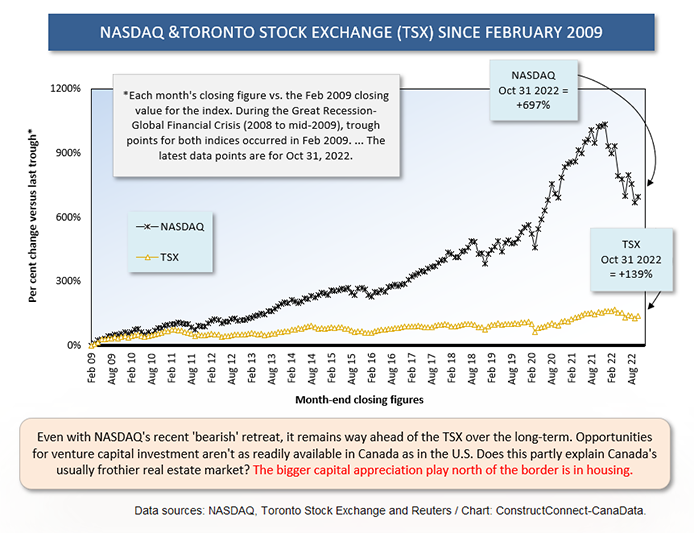

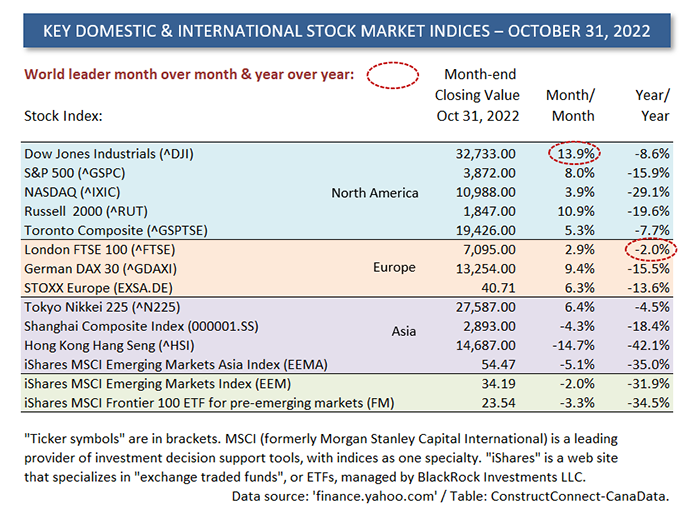

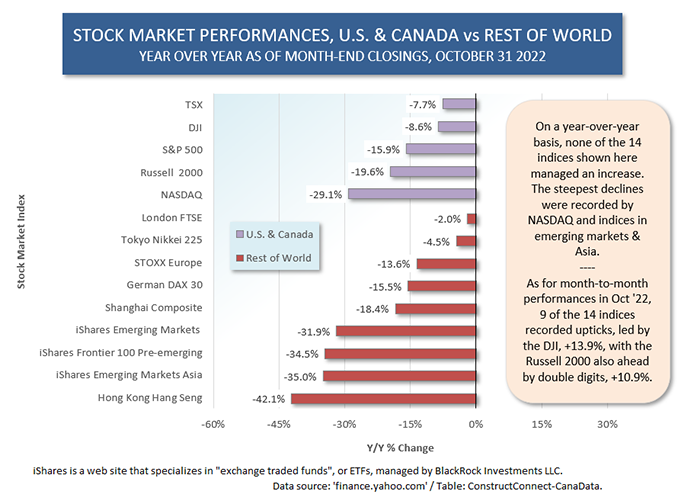

At the end of October, NASDAQ remained deeply ‘bearish’ on a year-over-year basis, at -32.2% versus its 52-week high. The S&P 500 was also in a gaping hole at -19.7%. But both indices recovered ground in the latest period. In October, NASDAQ was +3.9% m/m and the S&P 500, +8.0%.

Neither of those increases, though, was as impressive as the DJI’s m/m gain in October of +13.9%. The Russell 2000 also made an outstanding m/m leap, +10.9%. Nor was the TSX left out of the lineup of advances. Its m/m climb in October was a respectable +5.3%.

Where the poorest stock market results are currently being racked up are in emerging markets and, except for Japan, in Asia. The Nikkei 225 in Japan is doing okay. In October, it was +6.5% m/m and a not-so-bad -4.5% y/y.

But it’s the currency impacts of the Fed’s aggressive push on yields that is particularly hurting many smaller-GDP nations. The rate hikes are attracting international capital inflows to the U.S. that are elevating the value of the greenback. Many less developed economies have debt that is denominated in U.S. dollars. The rollover and carrying costs of those borrowing obligations are becoming more burdensome.

Plus, those countries are arguing that the Fed is exporting inflation. The higher-valued U.S. dollar is making the cost of imports for many less-dynamic nations more expensive, limiting their hopes for GDP improvement.

Worst of all globally at present is Hong Kong’s Hang Seng index, -14.7% m/m and -42.1% y/y in October. Beyond economic affairs, however, there’s more than just a dollop of geopolitical concern coloring those results. President Xi’s ascension to full control in mainland China all but ensures that moves to curtail Hong Kong’s independence in financial and other business matters will continue apace, rather than abating.

The importance of stock markets to the construction sector is that they provide a proxy measure of business confidence. It takes a positive outlook on the future to mitigate the risk that is part of any major capital spending adventure.

Table 1

Graph 1

Graph 2

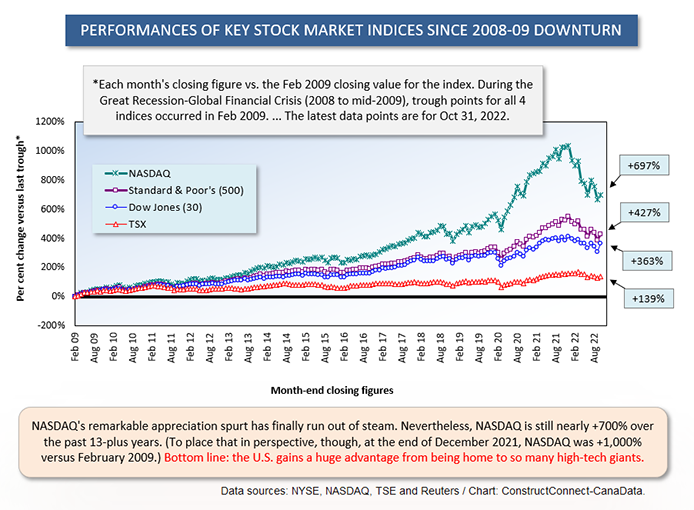

Graph 3

Graph 4

Table 2

Graph 5

Alex Carrick is Chief Economist for ɫ��ɫ. He has delivered presentations throughout North America on the U.S., Canadian and world construction outlooks. Mr. Carrick has been with the company since 1985. Links to his numerous articles are featured on Twitter , which has 50,000 followers.

Recent Comments

comments for this post are closed