Existing home sales took a bit of a breather in March. After hitting a post-Omicron-induced surge of 62,200 units in February, sales of existing homes eased slightly to 58,800 units in March. The supply of homes listed for sale also pulled back, by -5.5% m/m. During the month, the MLS House Price Index for Canada increased by +2.2%, moving from $868,200 to $887,000. The composite price was up by +27% y/y, just slightly below the record high of +29% y/y reached in February.������ ��

Strong fundamentals drove home construction to record high in 2021

Last spring, we wrote that “housing demand (in Canada) will cool – but not overnight”. Well, the slowdown in housing demand has been even more protracted than expected for several reasons. At the top of the list is interest rates. Although nominal fixed mortgage rates have risen by 80 basis points since the beginning of 2021, the impact has been muted by more borrowers opting for variable-rate mortgages. Second, full-time hiring has increased by +3.5% over the past year, lifting the total number of jobs nation-wide above the previous peak achieved in January of 2020, before the first wave of COVID-19. Third, admissions of permanent residents to Canada have rebounded. In the past six months, according to Immigration, Refugee and Citizenship Canada, 255,700 permanent residents have been admitted, more than twice the 104,100-figure for new arrivals during the comparable period prior. ��

Bank of Canada’s rate hikes will take time to cool demand

Although the Bank of Canada has increased its policy interest rate to 1%, started quantitative tightening, and has announced its intention to reduce excess demand to bring the inflation rate (currently at 6.7%) back to its 2% target rate, these measures will take time to cool the overall economy and the housing market. The impact of the recent increases in interest rates and the accompanying tightening of the mortgage qualifying stress test will gradually intensify throughout the second half of this year.�� As a result, affordability, which the Royal Bank recently noted was deteriorating in worrisome fashion, will worsen further, thus sidelining an increasing proportion of first-time home buyers.

Between now and the end of the year, however, several factors will temporarily support housing demand. These include a near-record low for the ‘number of months’ supply of existing homes for sale’ in all provinces and a record (since 1990) low inventory of completed and unabsorbed homeowner and condominium (new) dwelling units. Also, as noted above, the rate of increase in admissions of permanent residents is likely to remain high, helping to underpin demand for purpose-built and condo rental units. Finally, for the four months leading into January of this year, the percentage of mortgages in arrears remained at a record low of 0.17% and no region of the country saw a significant change. ��

Expect slowdown in starts and lower prices in 2022’s second half��

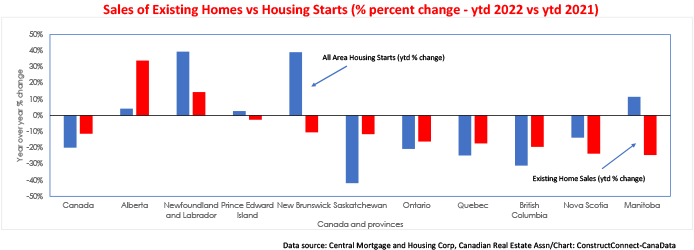

Ahead of the recent (April 13) hike in interest rates, there were indications the combination of unprecedented increases in average existing house prices and the eroding effect of high inflation on disposable incomes was dampening both the supply of and the demand for housing. ��Across the country, sales of existing homes are down by -12.4% year to date. And although average house prices are up by double-digit percentage changes in all but two major markets, they have decelerated in most metro areas.�� Despite persisting double-digit increases in existing house prices, the number of dwelling units started year-to-date is down -20% compared to the same period 12 months earlier. Provincially, declines in the number of units started in Saskatchewan (-42%), British Columbia (-31%), Quebec (-15%) Manitoba (-13%), and Ontario (-5%) have more than offset gains in the resource-based provinces of Newfoundland (+39%), New Brunswick (+39%), Manitoba (+11.5%) and Alberta (+4.2%).

Interest rate headwinds will slow residential construction through 2023

The effects of the above-noted deterioration in affordability due to high house prices and the prospect of further increases in interest rates will cause the pace of residential construction to steadily slow through the second half of this year and into 2023.�� As a result, we expect that, after hitting a record high of 271,000 units in 2021, housing starts will slow to 245,000 units this year and to 220,000 units in 2023. Reflecting the slowdown in demand, we anticipate average house prices to increase by +13% this year and by +2.5% in 2023 after rising by a record +21% in 2021.

John Clinkard has over 35 years’ experience as an economist in international, national and regional research and analysis with leading financial institutions and media outlets in Canada.

Recent Comments

comments for this post are closed