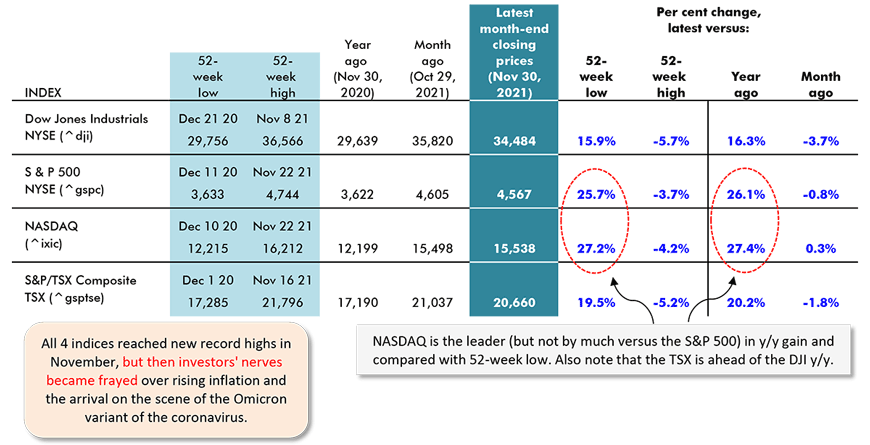

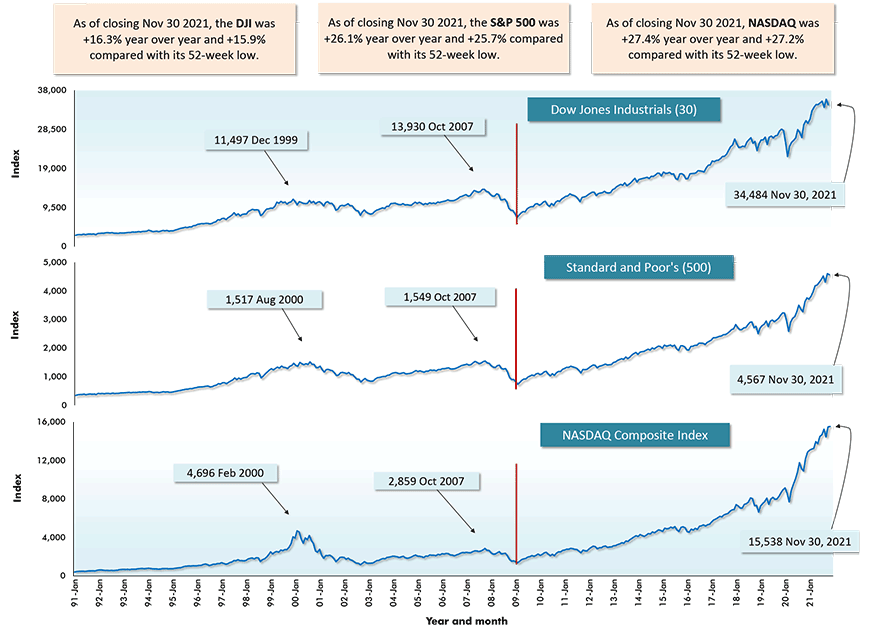

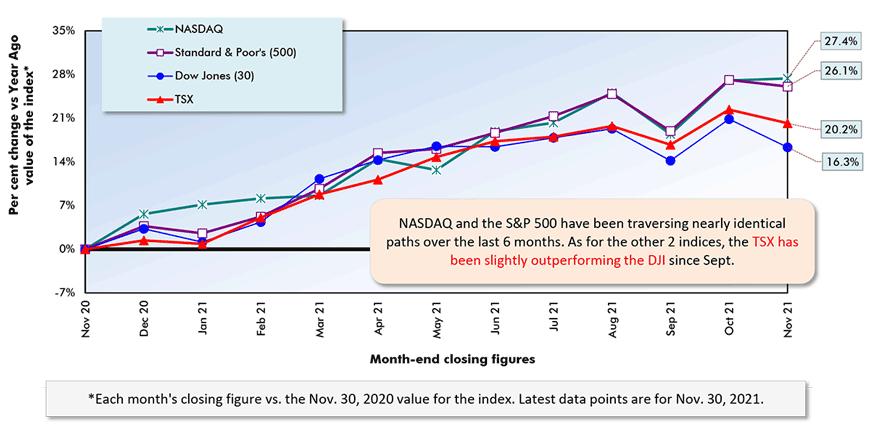

The DJI, S&P 500, NASDAQ and TSX have been setting new record highs in each successive month on a regular basis since early days in the pandemic. Nor did November fail to deliver success on that score once again. In the latest month, new peaks were established by the four major indices.

But towards the end of November, things took a different turn. The upward pressure on interest rates from rapid inflation is one concern that is capturing investors’ attention. Perhaps having even more of a negative impact, however, is the upsurge in coronavirus cases caused by the Delta variant. Plus, there’s the uncertainty over how spreadable and injurious to health will be the Omicron variant.

At the least, the coronavirus is making clear it won’t be easily shoved off the stage or relegated to the chorus. In different iterations, it’s going to keep demanding time in the spotlight. Worry over how this may sideline recovery has made investors wary.

By the end of November, the DJI’s closing value was -5.7% versus its earlier high. The S&P 500 was -3.7%; NASDAQ, -4.2%; and the Toronto Stock Exchange, -5.2%.

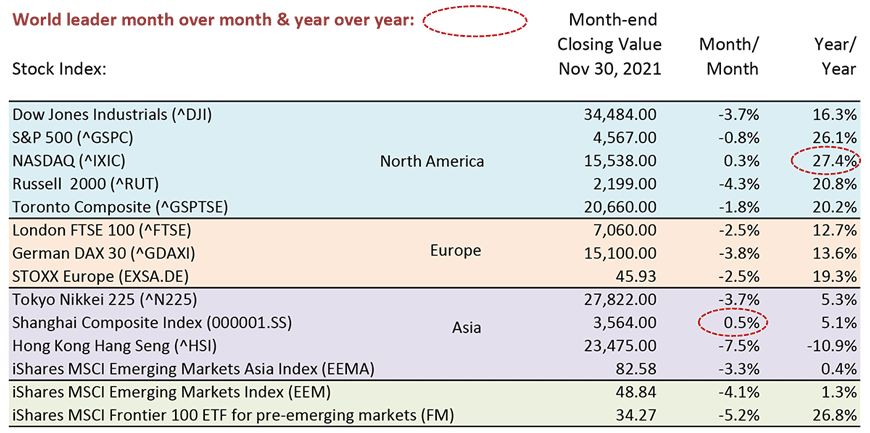

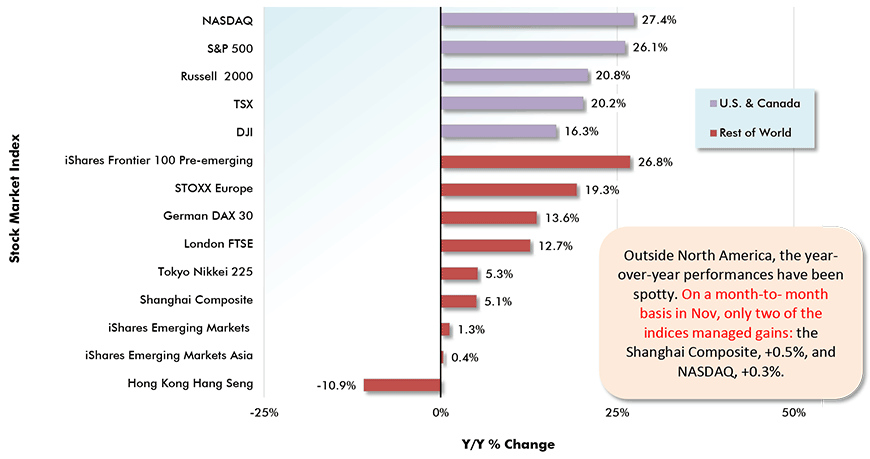

More telling, though, have been the month-to-month changes. Table 2 and Graph 4 show results for 14 indices from around the world. Only two of the 14 indices pulled off climbs from October 29th to November 30th, the Shanghai Composite (+0.5%) and NASDAQ (+0.3%).

The index with the worst record month to month in November was Hong Kong’s Hang Seng, -7.5%.

Setting aside the short-term gloom, NASDAQ continues to lead the world in year-over-year gain, at +27.4%, but it’s being closely chased by the iShares pre-emerging markets index, +26.8%, and by the S&P 500, +26.1%.

Next in line for y/y jumps are the Russell 2000, +20.8%, and the TSX, +20.2%.

Up by a fifth, also, is STOXX Europe, +19.3%, although neither the German DAX 30 nor London’s FTSE are doing as well, +13.6% and +12.7% respectively.

Japan’s Nikkei is ahead by a humdrum +5.3% y/y.

Among the 14 international indices, the lone negative percentage change year over year belongs to the Hang Seng, -10.9%.

Importance for Construction

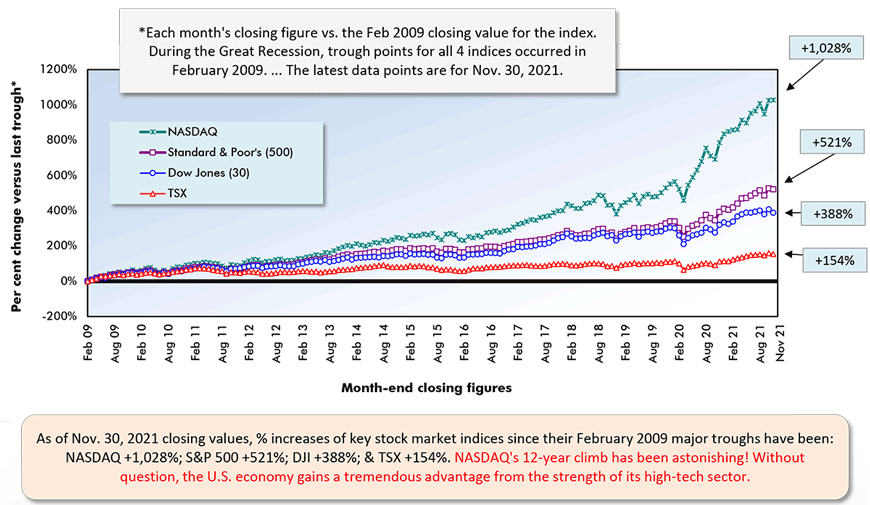

What’s the importance of stock market joy or sadness for construction? For consumers, there are specific surveys to reveal ‘confidence’ levels. For investors, how the stock markets are doing serves as the best gauge of their confidence in the prospects for the business community.

In turn, a good business prognosis directly impacts capital spending on machinery and equipment and, not to be forgotten, structures.

Securities Dealers Automated Quotations (NASDAQ), Toronto Stock Exchange (TSE) and Reuters.

Table: ɫ��ɫ.

Red vertical lines denote Feb 2009 major ‘troughs’ for the indices.

Securities Dealers Automated Quotations (NASDAQ), Reuters & Yahoo.

Chart: ɫ��ɫ.

Securities Dealers Automated Quotations (NASDAQ), Toronto Stock Exchange (TSE) and Reuters.

Chart: ɫ��ɫ.

Securities Dealers Automated Quotations (NASDAQ), Toronto Stock Exchange (TSE) and Reuters.

Chart: ɫ��ɫ.

Table: ɫ��ɫ.

Year over Year as of Month-end Closings, November 30, 2021

Chart: ɫ��ɫ.

Alex Carrick is Chief Economist for ɫ��ɫ. He has delivered presentations throughout North America on the U.S., Canadian and world construction outlooks. Mr. Carrick has been with the company since 1985. Links to his numerous articles are featured on Twitter , which has 50,000 followers.

Recent Comments

comments for this post are closed