The construction sector is presently generating several big news stories. One relates to building material costs; another concerns infrastructure spending plans. But in this article, through standalone graphs, I’d like to show the boom that is currently underway in housing starts, evident more so in Canada, but also quite apparent in the United States.

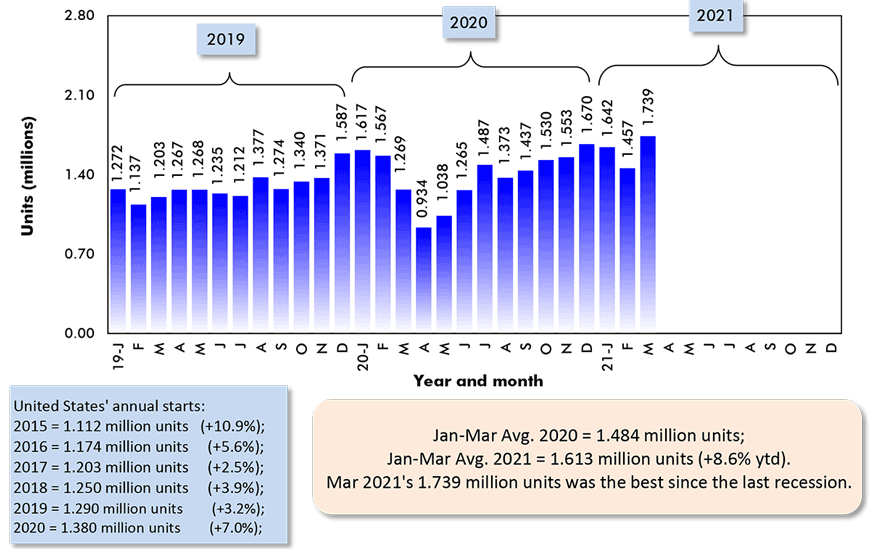

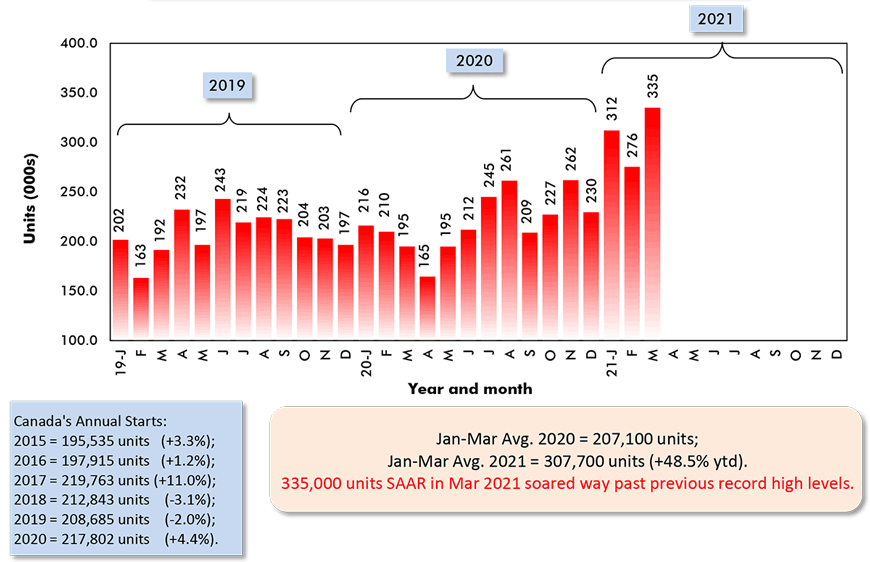

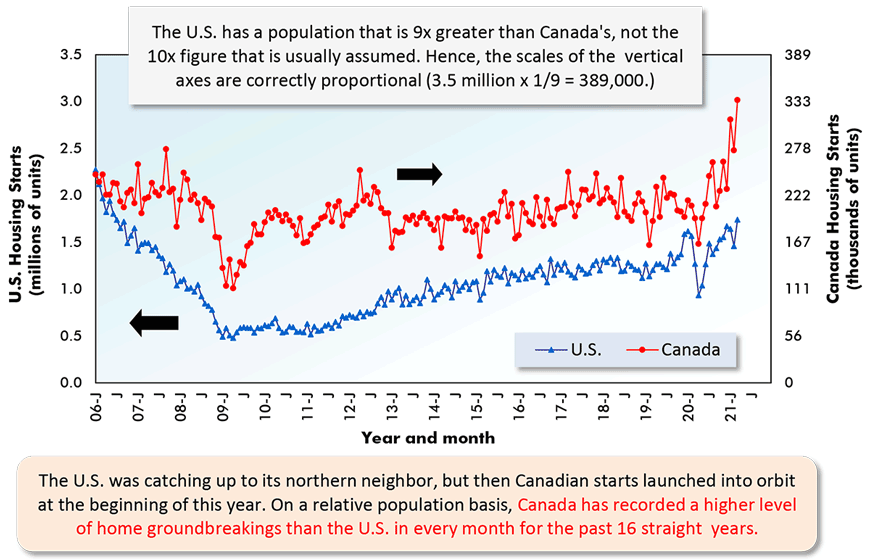

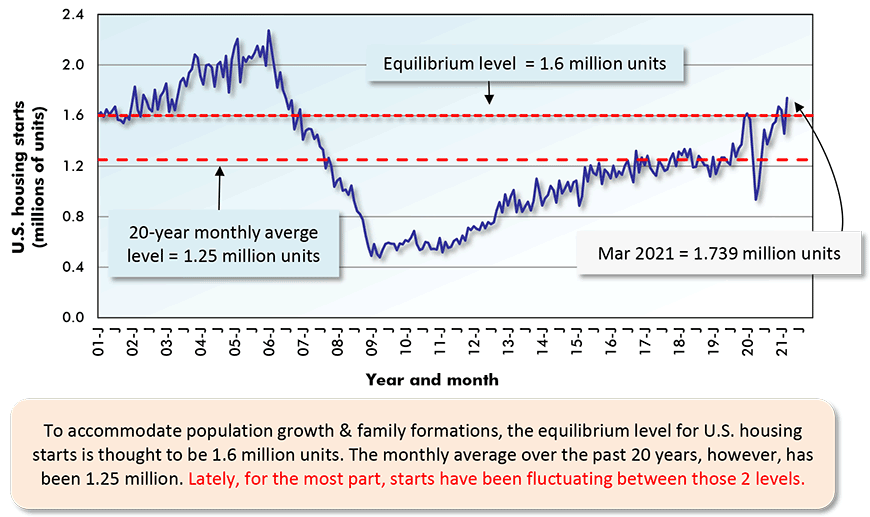

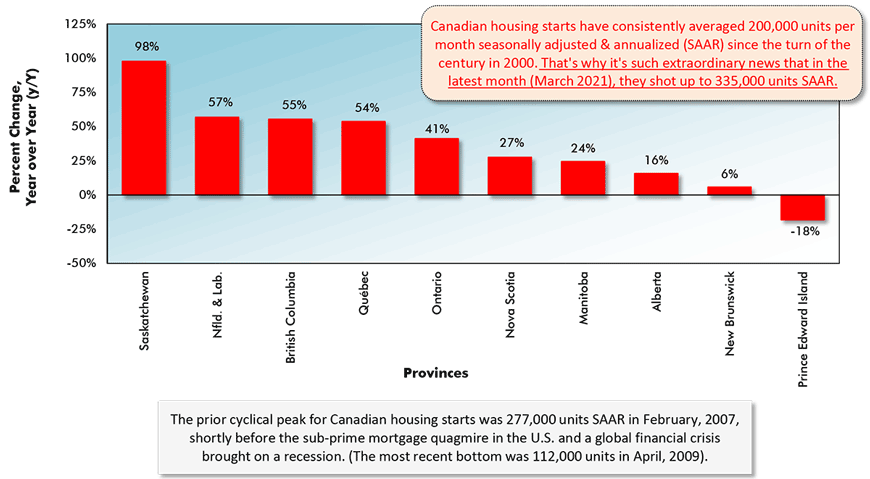

In March, U.S. housing starts climbed above 1.7 million units seasonally adjusted and annualized (SAAR) for the first time since before the previous recession (i.e., the 2008-09 ‘global financial crisis’). Meanwhile, in Canada, housing starts have soared more than 50% above their long-term average (200,000 units) and 20% beyond their previous cyclical high point (277,000 units).

In March, Canadian new home starts skyrocketed to 335,000 units SAAR, according to CMHC. That’s a figure I doubt many analysts thought they would see any time soon, especially given that population growth through immigration has slowed to a crawl due to pandemic-related border-crossing closures.

Absent the inflow of individuals from afar, the housing booms in both the U.S. and Canada are being generated domestically. Working from home to combat COVID-19’s spread is inspiring a whole lot of people to want to upgrade the ambience of where they are now spending almost all their time.

Plus, bargain interest rates are hanging on ‘financing trees’ like bright shiny baubles to be grabbed before they disappear.

In the following 12 graphs, the text boxes will lead readers through a story that will hopefully be the first of many indicating much sturdier underpinnings for the U.S. and Canadian economies as we transition away from the health crisis and towards sunnier prospects.

Graph 1: U.S. Monthly Housing Starts

Seasonally Adjusted at Annual Rates (SAAR)

Data source: U.S. Census Bureau (Department of Commerce).

Chart: ɫ��ɫ.

Graph 2: Canada Monthly Housing Starts

Seasonally Adjusted at Annual Rates (SAAR)

Data source: Canada Mortgage and Housing Corporation (CMHC).

Chart: ɫ��ɫ.

Graph 3: U.S. and Canada Monthly Housing Starts

Seasonally Adjusted at Annual Rates (SAAR)

The last data points are for March 2021.

ARROWS: U.S. numbers to be read from left axis; Canadian from right axis.

Data sources: U.S. Census Bureau & Canada Mortgage and Housing Corp (CMHC).

Chart: ɫ��ɫ.

Graph 4: U.S. Total Monthly Housing Starts

Seasonally Adjusted at Annual Rates (SAAR)

The last data points are for March 2021.

Data source: U.S. Census Bureau (Department of Commerce).

Chart: ɫ��ɫ.

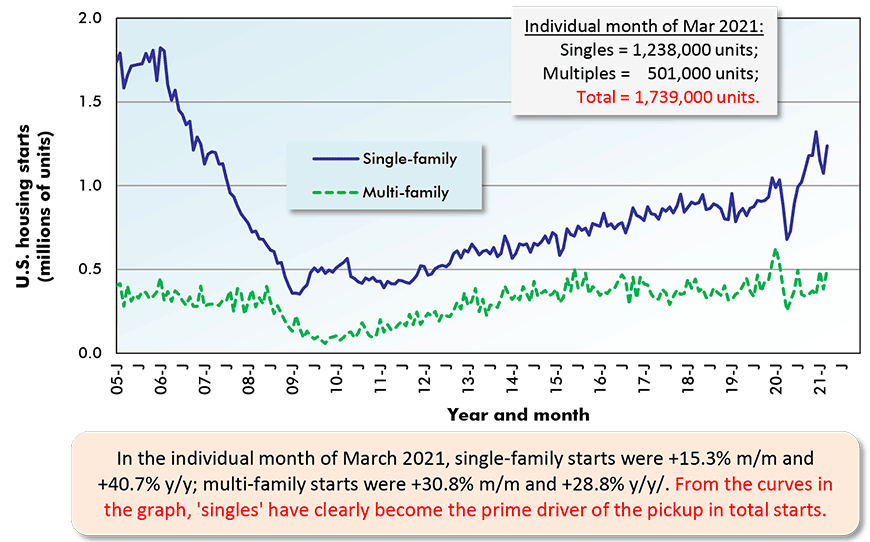

Graph 5: U.S. Single-Family & Multi-Family Monthly Housing Starts

Seasonally Adjusted at Annual Rates (SAAR)

The last data points are for March 2021.

Data source: U.S. Census Bureau (Department of Commerce).

Chart: ɫ��ɫ.

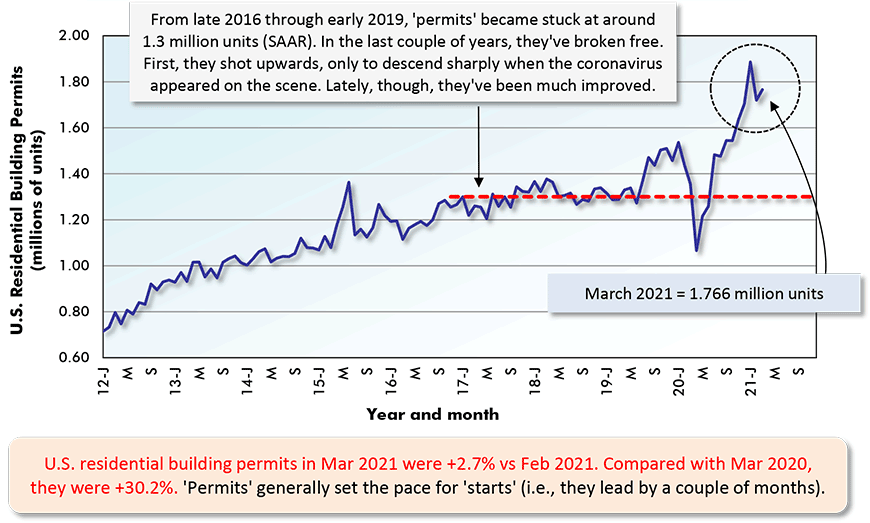

Graph 6: U.S. Monthly Residential Building Permits

Seasonally Adjusted at Annual Rates (SAAR)

The last data point is for March 2021.

Data source: U.S. Census Bureau (Department of Commerce).

Chart: ɫ��ɫ.

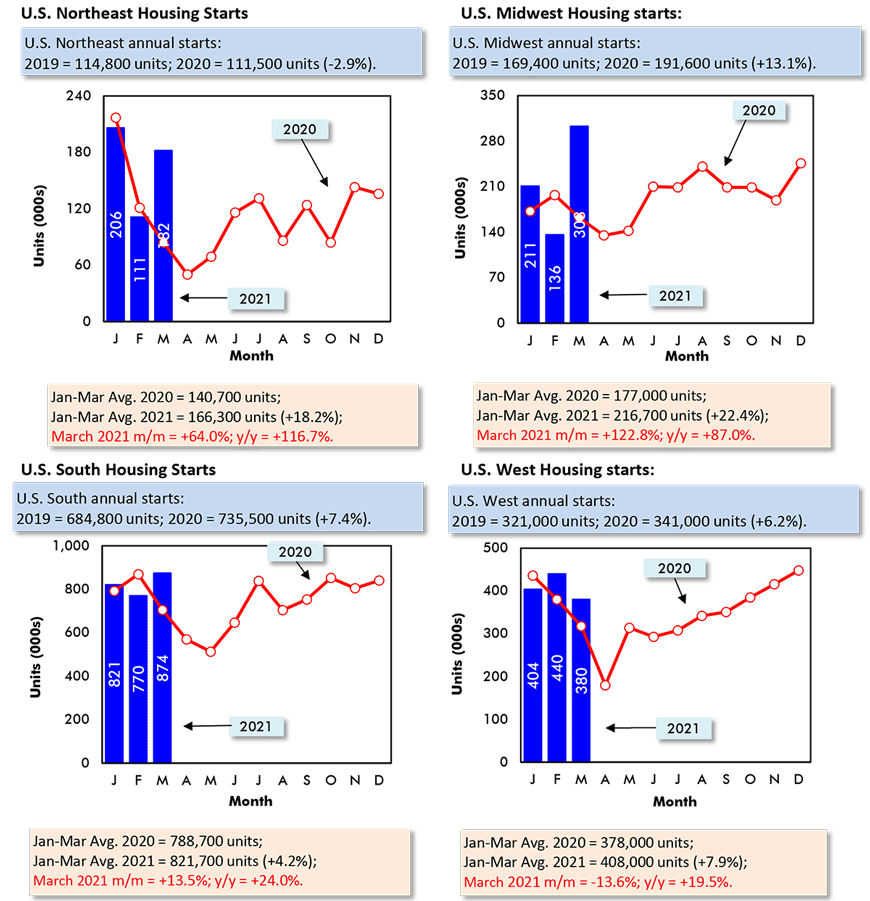

Graph 7: U.S. Regional Housing Starts (SAAR) – March 2021

Data source: U.S. Census Bureau (Department of Commerce).

Chart: ɫ��ɫ.

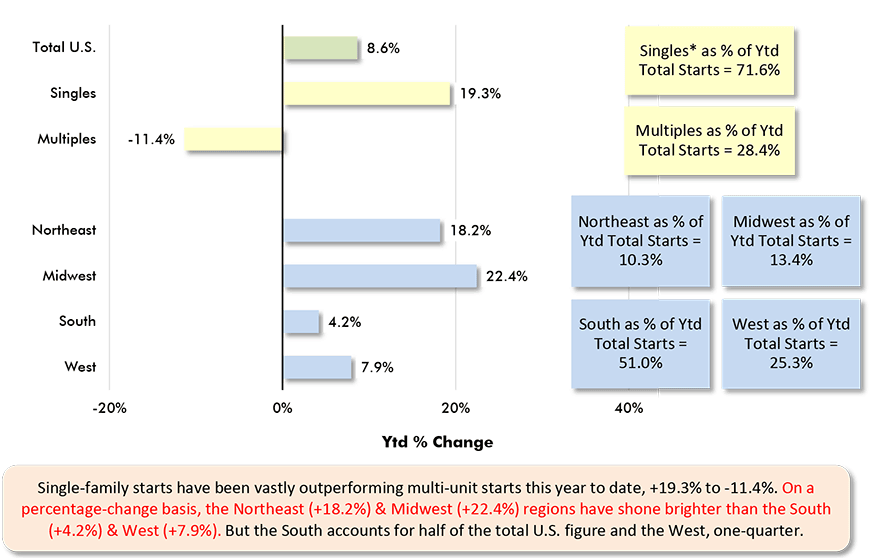

Graph 8: U.S. Housing Starts

Jan-Mar 2021 vs Jan-Mar 2020 % Changes

Based on averages of monthly seasonally adjusted and annualized (SAAR) unit starts.

* ‘Singles’ includes townhouse complexes, except when multiple units have common heating & air conditioning.

Data source: U.S. Census Bureau.

Chart: ɫ��ɫ.

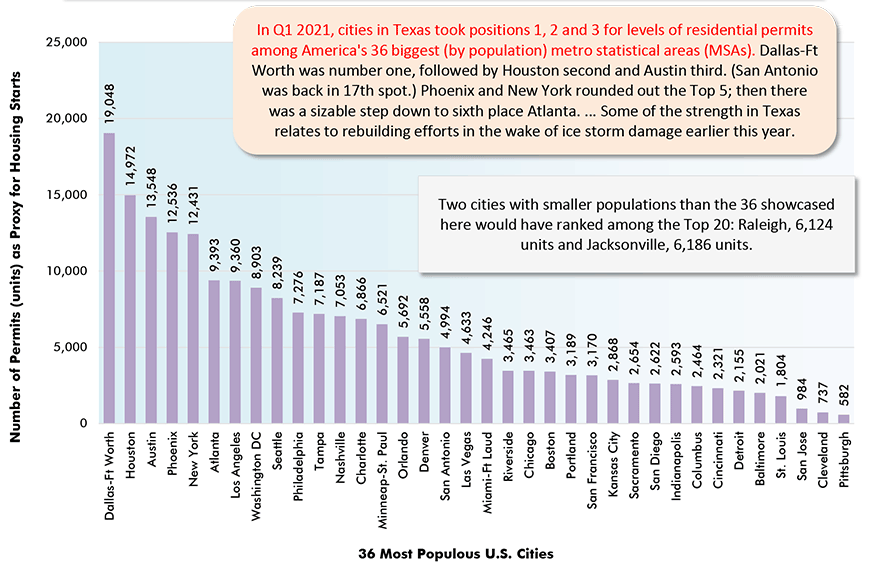

Graph 9: Year to Date Residential Permits Issued (Units) in the 36 Most Populous U.S. Metro Statistical Areas (MSAs)

(Jan-Mar 2021)

At the city level, the number of residential building permits issued serves as a proxy for housing starts.

Data source: U.S. Census Bureau.

Chart: ɫ��ɫ.

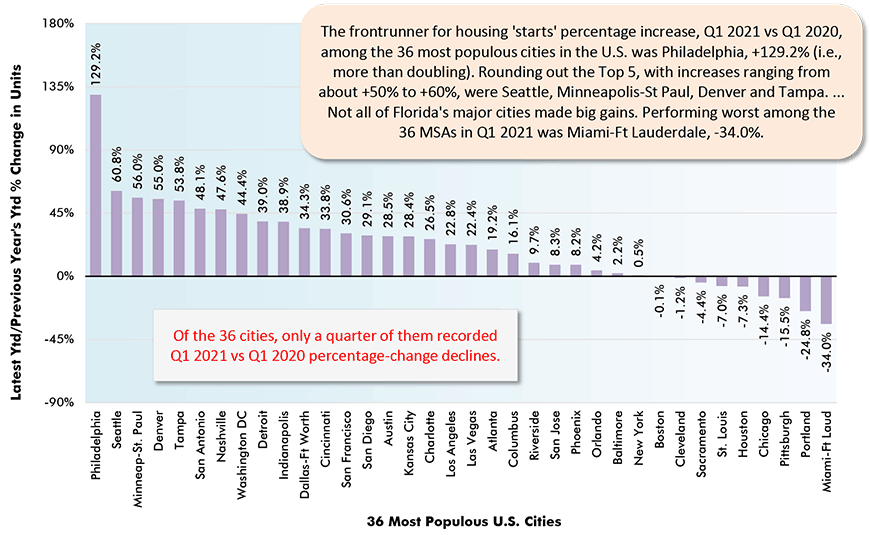

Graph 10: Percent Change in Year-to-Date Housing Permits Issued (Units) in the 36 Most Populous U.S. Metro Statistical Areas (MSAs)

(Jan-Mar 2021 vs Jan-Mar 2020)

At the city level, the number of residential building permits issued serves as a proxy for housing starts.

Data source: U.S. Census Bureau.

Chart: ɫ��ɫ.

Graph 11: Percent Change in Year-To-Date Housing Starts –

Ranking Of Canada’s Provinces

(Jan-Mar 2021 vs Jan-Mar 2020)

Data source: Canada Mortgage & Housing Corporation (CMHC) based on actuals rather than seasonally adjusted data.

Chart: ɫ��ɫ.

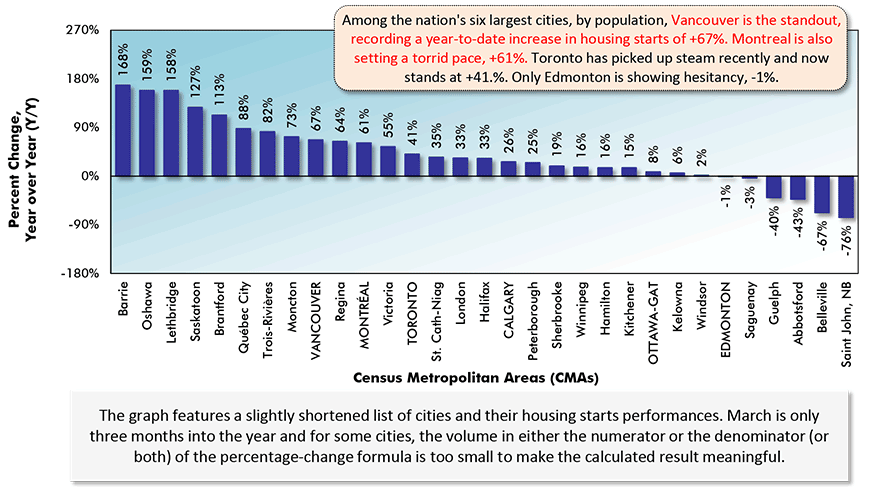

Graph 12: Percent Change in Year-To-Date Housing Starts –

Ranking Of Canada’s Major Cities

(Jan-Mar 2021 vs Jan-Mar 2020)

Canada’s Census Metropolitan Areas (CMAs) have core populations of 50,000 plus.

Canada’s 6 CMAs with populations in excess of 1 million are in capital letters.

Data source: Canada Mortgage & Housing Corporation (CMHC) based on actuals rather than seasonally adjusted data.

Chart: ɫ��ɫ.

Please click on the following link to download the PDF version of this article:

Alex Carrick is Chief Economist for ɫ��ɫ. He has delivered presentations throughout North America on the U.S., Canadian and world construction outlooks. Mr. Carrick has been with the company since 1985. Links to his numerous articles are featured on Twitter , which has 50,000 followers.

Recent Comments

comments for this post are closed