Fasten your seatbelts.

The residential construction industry is in for a rocky ride. The new condo market is at the edge of a very large cliff as sales have tumbled, inventory is rising and projects have been put on hold.

It’ll be a couple of years before the inventory is cleared and new building begins.

The number of cranes in the Greater Toronto Area (GTA) is down roughly 22 per cent this year. Each crane represents employment for 50 people, so that’s a lot of workers that are unemployed.

The figures, presented recently at a housing summit sponsored by RESCON, paint a disturbing picture for the residential construction sector that will have serious economic consequences.

In the GTA this year, condo sales alone are 81 per cent below the 10-year average. Purpose-built rental apartment starts are down 30 per cent from 2023 — and still falling. Home prices, meanwhile, are four to five times higher than they were 20 years ago and, over the same period, the price of land is 10 to 11 times higher, while development charges are 30 per cent higher.

Corey Pacht, partner and executive VP of operations at Fitzrovia, told the summit the situation for residential construction is much worse than it appears, while Marlon Bray, executive VP at Clark Construction Management, said the taxation and approvals systems are broken.

The warnings were crystal clear. The industry can expect more pain unless governments take drastic action.

To be fair, governments have made some inroads. But they’ve been tinkering around the edges and not tackling the systemic issues of high taxes and slow approval times, which both add to cost.

Provincially, the government is trying to create conditions to get shovels in the ground faster via initiatives such as extending strong mayor powers to municipalities like Toronto, pumping $3 billion into a program to fund critical infrastructure, and putting a focus on cutting red tape.

The province is also implementing a new Provincial Planning Statement, which includes measures to support construction of more housing by streamlining planning regulations and approvals processes, improving land availability for development and building much-needed infrastructure. It also requires municipalities to set minimum affordable housing targets.

Both the federal and provincial governments, meantime, have cut sales taxes on new purpose-built rental housing, and the feds have established a $4-billion Housing Accelerator Fund to inspire initiatives to build homes faster. These are all positives, but don’t address other pressing issues.

One of the big problems we have in Ontario is that too much authority for some pretty basic planning items is left to municipalities. The City of Toronto, for example, is still dancing around the issues of angular planes and size restrictions on floor plates in apartment buildings.

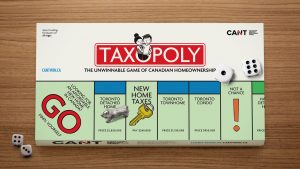

But the real elephant in the room is the myriad taxes, fees and levies that are applied to new home construction. Government charges account for roughly 31 per cent of the cost of a new home.

In particular, development charges (DCs) imposed by municipalities are taking a toll on the industry. They are simply out of control.

In Toronto, DCs for single-detached homes have increased from $12,910 in 2010 to $141,139 in 2024 — a whopping 993-per-cent hike.

The charges have increased 42 per cent in less than a year in the GTA. By comparison, development charges on a comparable new home in Calgary are just $22,000.

At our housing summit, it was refreshing to hear some big city mayors express that they were open to discussing changes to DCs.

London Mayor Josh Morgan, for one, explained he doesn’t mind doing DCs in a different way, but municipalities must find a way to replace the funds. Guelph Mayor Cam Guthrie said municipalities need consistent funding from the province to support the housing infrastructure that the DCs are intended to fund. DCs are paid by builders and passed on to consumers.

Toronto Mayor Olivia Chow said the province would have to provide some sort of provincial building rebate to cities to offset development fees that have been waived to meet statutory requirements.

It was a start.

Builders are eager to meet the challenge and are ready and willing to build the housing to keep up with our rapid population growth, but the restrictive rules, cumbersome processes and exorbitant fees are making it too expensive and delay the time it takes to launch a project.

Reducing the DCs would be a step forward. A study done by the CMHA determined that if builders didn’t have to pay permit, municipal and guarantee fees, development charges, or density payments, input costs for a 24-storey condo in Toronto could be decreased 15 per cent.

RESCON has been banging the drum on DCs for some time now. We have suggested that serious action be taken to provide tax breaks on all new housing. The Coalition Against New-home Taxes, which includes 19 developers, has also called on governments to reduce the taxes and DCs.

We can still turn this ship around, but it will take vision and plans that are focused. The clock is ticking.

Richard Lyall is president of the Residential Construction Council of Ontario (RESCON). He has represented the building industry in Ontario since 1991. Contact him at media@rescon.com.

Recent Comments