A consultation process has been launched by the Ontario government to implement pay-on-demand surety bonds as an alternative to Letters of Credit (LOC) for homebuilders, which the (OHBA) is calling a huge regulatory win.

The proposal, Enabling the Use of Pay-on-Demand Surety Bonds to Secure Land-Use Planning Obligations under Section 70.3.1 of the Planning Act, was posted to the Environmental Registry of Ontario by the Ministry of Municipal Affairs and Housing Sept. 16.

The government is proposing a regulation that would authorize landowners to stipulate pay-on-demand surety bonds to be used to secure municipal obligations that are conditions of land-use planning approvals, states the notice.

Wider acceptance of pay-on-demand surety bonds may help homebuilders to free up funds for housing projects.

“T��� reads that they are looking for consultations on ways to implement,” Scott Andison, CEO of the OHBA, told the Daily Commercial News.

“That signals very strongly the government has made the decision they want to proceed. They just want to figure out how best to do so, so that it really gives the maximum benefit to those municipalities and builders in support of getting more homes built.”

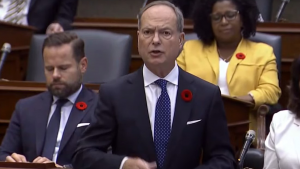

Minister of Municipal Affairs and Housing Paul Calandra has been championing the progressive regulatory change, Andison said.

A financial tool to help homebuilders get shovels in ground

For years, the OHBA has advocated to allow for surety bonds to be used in the place of LOC.

“This is a tool that municipalities will often ask builders for… to put a financial guarantee in place for work that they agreed to do as part of a development application,” Andison said.

“It could be putting in a park, it could be extending roads, it could be putting in other types of infrastructure. When the municipality approves the site plan application they just want something in there that gives them some guarantee and certainty that the builder will follow through on something. In the event, the very unlikely event, that a builder is unable to do that, then they can turn to this financial guarantee.”

In the past, the guarantee generally has been an LOC.

“This is issued by a bank on behalf of the developer and they put that into the municipality. What it does, let’s say its $2 million. That $2 million in that Letter of Credit is actually blocked for the builder, so that’s actually taken off the builders’ credit availability,” Andison said. “A building development could be two, three, even four years in play, so that really restricts the builder’s ability to do additional concurrent projects because they have had that credit taken away.”

The regulation would help free up capital that homebuilders can now invest into future projects, instead of it being held up in LOCs. Municipalities like Whitchurch-Stouffville, Pickering, Hamilton and Bracebridge voluntarily accept another tool called the surety bond, Andison noted.

“From the bank’s perspective, there is no additional risk for them using a surety bond,” he said. “Think of it like insurance. This is an insurance premium that’s paid and in the very unlikely event that a builder is unable to fulfill their obligation, then this insurance provision gets triggered and the obligations are fulfilled for the municipality. The main difference between the surety bond and the Letter of Credit is that it doesn’t tie up the builder’s credit capital.”

Consultation closes Oct. 16

The consultation is open for 30 days, concluding on Oct. 16.

The OHBA will be submitting feedback on behalf of the industry and the 28 local associations across the province. A focus for the association during this consultation will be to ensure that builders currently using LOCs can easily transition to surety bonds.

“One of the recommendations we’ll be putting in…is that where a builder has a Letter of Credit in place with a municipality, once surety bonds are authorized by the regulation that gets passed, the builder should have the ability to go to the municipality and say, ‘I would like to swap the current Letter of Credit with a surety bond so that I can get access to that credit capacity again,’” Andison said.

Builders are not required to use this, he pointed out.

“If for whatever reason a builder still wanted to continue to use the Letter of Credit, they are free to do so,” he said.

Follow the author on X/Twitter @DCN_Angela.

Recent Comments

comments for this post are closed